Best Vehicle Insurance for Everyone

Contact Us

Safer Travels with Inurance

Contact Us

SLS Insurance Services is a trusted name in the insurance industry, providing reliable and transparent insurance solutions. Our mission is to offer multi-company insurance plans at the most competitive prices, ensuring our customers receive optimal coverage, expert advice, and dedicated claim support.As a certified IRDAI (Insurance Regulatory and Development Authority of India) Agent, we have been committed to excellence since our establishment in 2014. With 15+ years of experience, we continue to set new industry benchmarks, redefining what it means to be a comprehensive insurance provider with superior customer service. At SLS Insurance Services, we do more than just provide insurance—we build trust, security, and lasting relationships with our valued customers.

To be the most trusted and customer-centric insurance provider, offering innovative, transparent, and hassle-free motor vehicle and non-life insurance solutions. We strive to set new industry benchmarks in service excellence, client satisfaction, and claim support, ensuring peace of mind for every policyholder.

Contact UsOur mission at SLS Insurance Services is to provide comprehensive insurance solutions with efficiency and honesty. We understand our clients’ needs, offer doorstep services, and maintain open communication to foster trust and loyalty, all backed by our 5-star Google rating and extensive experience.

Contact UsOur team includes well-trained, experienced professionals who have a serious and conscientious attitude towards the clients and are capable of handling any question you may have about your insurance coverage. Here, at SLS insurance, we first try and understand the client’s requirement and their Premium Paying Capacity, which helps us to offer tailor made solutions which fits as per the clients need. Our objective is to make our client understand the insurance coverage need also which should be the correct option to choose as per their vehicle they own which is supposed to be insured. We have the capability to handle any case and get you the coverage you deserve. We are Providing solutions of non-life insurance Like All Type Of Motor Insurance , health Insurance , travel insurance, Fire insurance

Many health insurance companies are offering various family health insurance plans in India. Finding the best mediclaim policy for family can be a daunting task for the customers. To make it easier for you, sls Insuranceservices has put together a list of "Best Family Health Insurance Plans in India" along with some of its coverage benefits

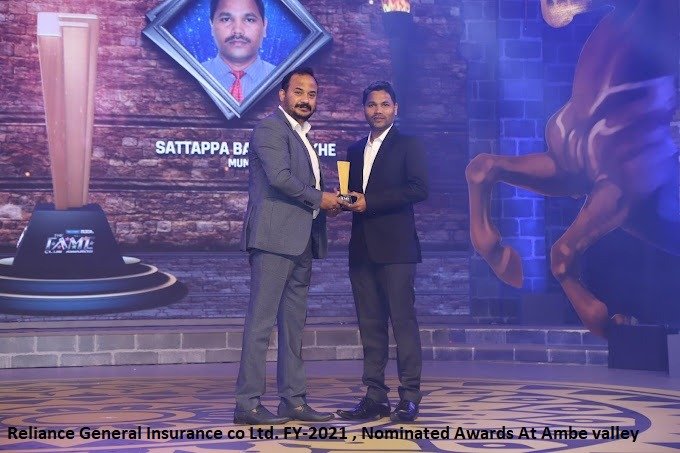

Managing DirectorMr. S. B. Salokhe, Founder and Managing Director of the Sls Insurance Services of companies has over 10 years of experience in the General Insurance sector. His experience ranges over a wide variety of industries. Mr.salokhe has More Than 17Years experienced In Insurance industries

Managing Director Mrs L. S. Salokhe,Co- Founder and Managing Director of the Sls Insurance Services of companies has over 10 years of experience in the General Insurance sector. His experience ranges over a wide variety of industries. Mrs.salokhe has More Than 10 Years experienced In Insurance industries

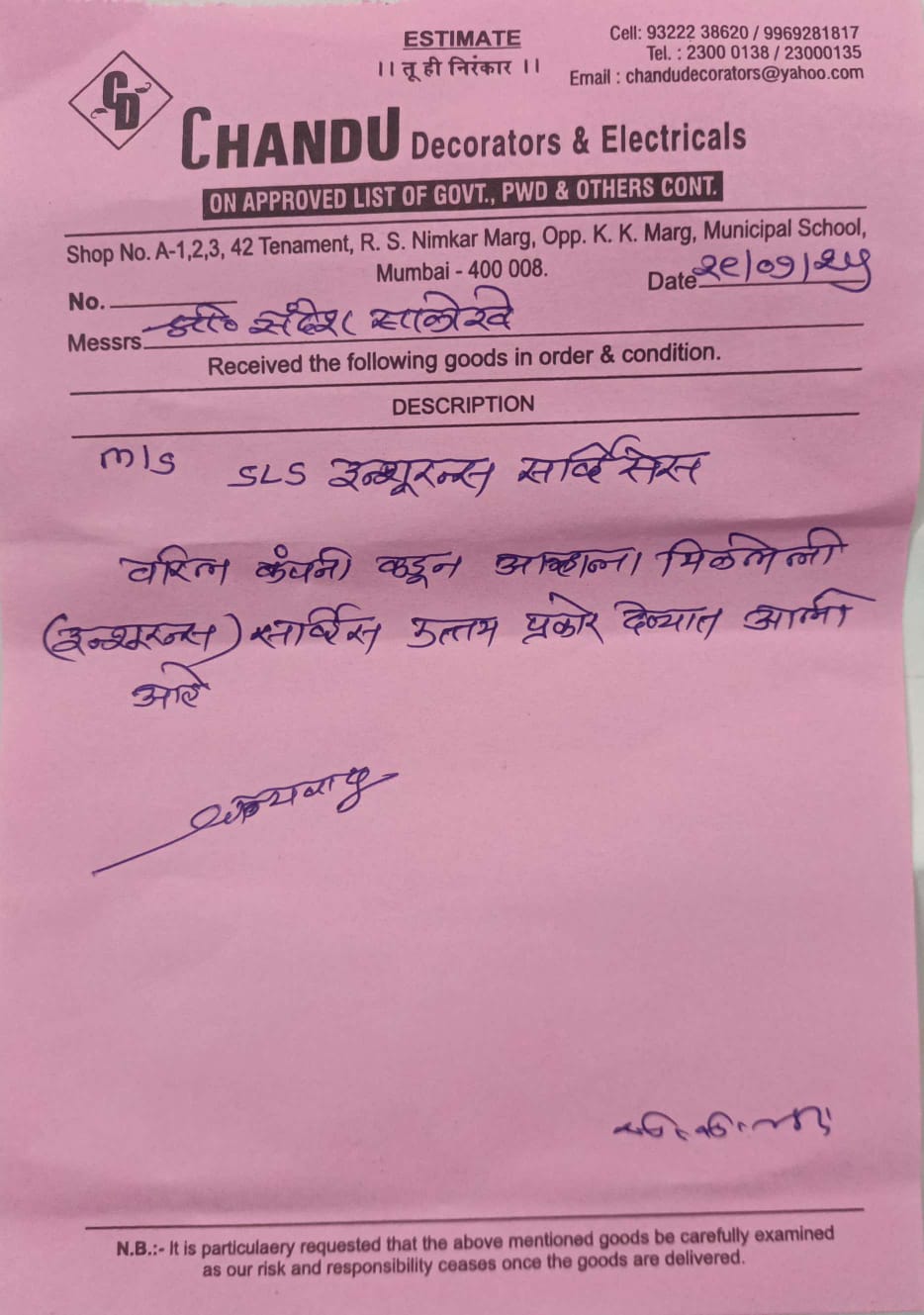

"Best services for vehicle insurance , all vehicle done from sls insurance services , Regards Proprietor of Swarup Tours"

"Very Good Job"

"SLS इन्शुरन्सची अतिउत्तम सर्व्हिस आहे . मी अनेक वर्ष पाऊण इन्शु"रन्स घेत आहे.

"I really appreciate your follow ups & you were of great help in renewal without much hassle. Recomend your services."

"Our company Name J k Refrigeration company Ltd Mumbai our all insurance doing from SLS insurance services.Very nice, helpful and excellent service with a smile. I would definitely recommend them since they provide the best service."

"As a corporate employee we require insurance services for a host of difference avenues. From cargo vehicle insurance ; general site team insurance to transit insurance these guys do it and at the best price. Kudos to Sandesh salokhe and team. Keep up the great service ! "

"Good experience and trust worthy people"

"SLS Insurance Services ,Best Vehicle Insurance advisor.. who gives all help during vehicle insurance claim , always available, Quick service and guidance..Recommended to everyone who is looking for vehicle insurance insurance advisor"

"Good service...❤️💫"

The limited liability insurance policy is an insurance policy that’s also referred to as the third-party insurance policy. As per the Motor Vehicle Act of 1988, this insurance policy is designed to provide coverage in case of car accidents involving a third-party individual and their car/property. This covers the cost of repair or replacement of vehicle parts if a third party’s vehicle is damaged in an accident. As the name suggests, this policy comes with limited coverage in that it only includes the third party injured in the accident and not the policyholder per se.

Perhaps the most popular type of motor insurance coverage is the comprehensive coverage insurance policy. This is an all-round policy, which covers both, the policyholder and the third party in case of an accident leading to hospitalisation and/or vehicle/property damage. Apart from accidents and vehicle damage, it is also equipped to cover you against loss or damage of vehicle due to natural disasters like earthquakes, floods, tornadoes, fire, storms, etc., as well as human incidents like riots, strikes, terror activities, thefts, etc. Moreover, you can make your coverage even more comprehensive by adding the necessary add-on riders provided by your insurance company.

Conclusion: As per the Motor Vehicle Act of 1988, it is mandatory to have a limited liability car insurance. However, it is recommended to go for a comprehensive policy that covers the liability as well as the damage to your vehicle. The insurance premium you pay depends upon the type of car insurance you purchase. To maximise coverage, it is best to opt for a comprehensive policy featuring necessary add-on riders. Explore affordable car insurance quotes on sls Insurance. Being a Agent ,sls insurance provides a wide range of insurance policies, suitable for every budget., we take pride in our impeccable customer service facilities. You can reach out on our customer service helpline for assistance.Now that we know third party insurance meaning let’s find out the kind of coverage offered by insurance providers under this insurance policy. This policy covers the third party against:

Third party insurance doesn’t cover the following:

Purchasing an insurance policy is rather easy today. You can purchase insurance from your insurance broker or an agent. Today, you can even buy third party car insurance online from the website of your preferred insurance provider. Buying insurance online enables you to compare the various policies and choose one based on your requirements. While you receive an instant soft-copy of the policy on e-mail, the insurance provider also mails the hard copy to you. Moreover, you don't have to pay any brokerage fees or charges to your insurance agent, which enables you to save some money.

Conclusion: Driving without a valid insurance policy is a punishable offence. If you fail to produce your license, RC book, PUC certificate and insurance policy upon a traffic authority’s request, you could be penalised. You could be charged a heavy fine or even be served a jail sentence or both. As such, you must ensure that you always have the valid documents, including your third-party insurance or comprehensive insurance policy.Having explained comprehensive insurance meaning, let’s find out the coverage provided under this policy. As the name suggests, a comprehensive plan is one in which the policyholder is covered against a comprehensive range of on and off-road incidents. Here’s a list of things covered under a comprehensive car insurance policy:

There are a few basic things that are excluded or not covered under a comprehensive insurance policy. They are as under:

When it comes to a comprehensive insurance policy, no two premiums are the same. The insurance provider charges a premium based on several factors, including the make and model of the car, the city in which you live, your driving record, etc.

You can increase your insurance coverage by purchasing different types of add-on riders like engine protection cover, personal and passenger accident cover, return to invoice cover, road-side assistance cover, etc.

Insurance companies reward policyholders for not filing insurance claims. Upon renewing your comprehensive insurance plan, you can get a NCB discount of 20% to 50% on your motor OD premiums for not filing a claim for 1 to 5 consecutive years

X